Bimal Jalan committee’s recommendations accepted on surplus transfer 03/09/2019 – Posted in: Daily News

BIMAL JALAN COMMITTEE’s RECOMMENDATION

For: Mains

Topics covered:

- RBI to transfer its surplus to the government

- Components of the transfer

- Where do the reserves come from?

- How much should the RBI keep?

- Economic Capital Framework (ECF)

News Flash

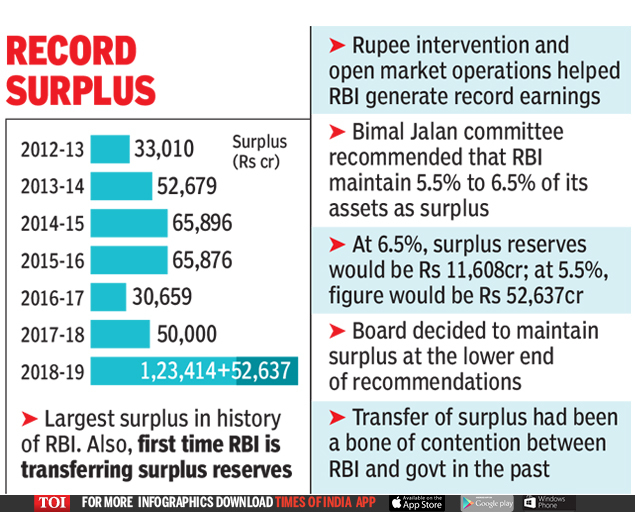

The Central Board of the Reserve Bank of India approved the transfer of Rs 1,76,051 crore, which is around 0.8 percent of GDP, to the Government of India.

- This decision is in line with the recommendations of the Bimal Jalan Committee.

- The Reserve Bank of India (RBI) to transfer its surplus under section 47 of the RBI Act, 1934.

Components of transfer

There are two components of this transfer.

- The first is surplus before the adjustment to excess risk provision amounting to ₹1,23,414 crore.

- The second is the amount written back from the contingency reserve fund aggregating ₹52,637 crore.

Key Highlights

- RBI pays dividends to the government every year, based on the profits from its investments and printing of notes and coins.

- The Bimal Jalan committee recommended that RBI should keep 5.5% to 6.5% of its total assets as the contingency risk buffer (CRB) to meet any emergency fund requirements and transfer the remaining funds to the government.

- Contingent Risk Buffer or CRB is a component of RBI’s economic capital required to cover its monetary and financial stability, credit and operational risks.

- The RBI said that is current contingency risk buffer stood at 6.8% of the balance sheet.

- The RBI’s central board decided to maintain it at 5.5% of the balance sheet and excess risk provisions of ₹ 52,637 crores were written back or transferred to the government.

- The committee said realised equity of RBI could be used to meet all risks and losses as they were built over a period of time through retained earnings, while revaluation gains were unrealised and hence not distributable.

Where do the reserves come from?

The central bank has three different funds that together comprise its reserves.

- Currency and Gold Revaluation Account (CGRA) – the largest make up of the RBIs reserve.

- Contingency Fund (CF) – second-biggest fund

- Asset Development Fund (ADF) – much smaller share of the reserve

How much should the RBI keep?

This has been a contentious issue. Currently, the government countered that the RBI had reserves far in excess of what the global norms were and, so, should transfer the excess.

Does this harm the RBI?

While it does not immediately do the RBI any harm. But the fact is that the central bank now has far less amount to deal with any crisis or financial catastrophe. The reserve have been emptied to its minimum amount.

This is a one-time bonanza and does not fix the fact that tax revenues (both direct and indirect tax) are coming in much lower than they need to.

Economic Capital Framework (ECF)

It is the amount of capital that a financial company or entity needs to ensure that it stays solvent given its risk profile.

Source: The Hindu

ALSO, READ MORE DAILY NEWS

- Mars solar conjunction

- Open Acreage Licensing Policy- IV

- McrBC: prevents viral infections in bacteria cell

- IMF’s Annual Observance Report of ‘Special Data Dissemination Standard’

- Moon’s craters captured by Chandrayaan 2

- The Coal in India 2019 report

You are on the Best Online IAS preparation platform. You are learning under experts.

We are present on Facebook- Diligent IAS, LinkedIn- Diligent IAS, YouTube- Diligent IAS, Instagram- Diligent IAS. Get in touch with us