Cooperative societies will be under the purview of Banking Regulation Act 19/11/2019 – Posted in: Daily News – Tags: Banking Regulation Act

cooperative credit societies

For: Preliminary & Mains

Topics covered:

- All about Cooperative Credit Society

- Roll of Reserve Bank of India to Cooperative societies

News Flash

Numbers of cooperative credit societies will have to seek banking license from the Reserve Bank of India (RBI) following amendment in the Banking Regulation Act.

Presently, cooperative credit societies are regulated and registered by the Registrar of Co-operative Societies. Their operations do not come under the purview of the banking regulator, RBI, despite accepting deposits and giving loans. While those cooperative credit societies with reserves and paid-up capital of over Rs 1 lakh have to register with RBI, most of these societies operated with a lower capital to avoid regulatory overview.

Following the amendment in the Banking Regulations Act, the RBI will issue details guidelines regarding the capital requirements that would apply for cooperative credit societies.

As per the amendment in the Act, these societies will have to comply to the norms specified by the RBI within one year of it being notified. Alternatively, they will be forced to suspend banking operations.

Aim

The move is aimed to protect the depositors interest since unlike cooperative banks and commercial banks wherein deposits of Rs 1 lakh is covered none of these entities have insurance cover on the deposits they mobilise.

Co-operative Banks

Co-operative banks are financial entities established on a co-operative basis and belonging to their members. This means that the customers of a co-operative bank are also its owners.

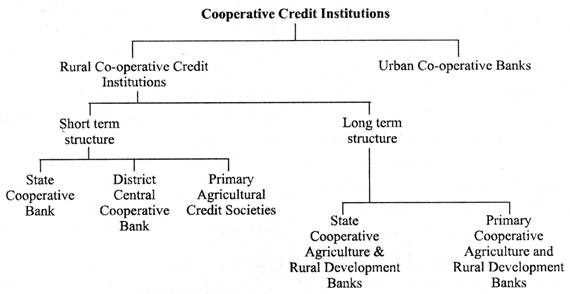

Broadly, co-operative banks in India are divided into two categories – urban and rural. Rural cooperative credit institutions could either be short-term or long-term in nature. Urban Co-operative Banks (UBBs) are either scheduled or non-scheduled. Scheduled and non-scheduled UCBs are again of two kinds- multi-state and those operating in single state.

Important Information

- IDBI Bank, itself has an in-house credit co-operative society even as it operates as a bank.

- As of now, all deposit-taking activities are regulated except for co-operative societies.

Source: The Hindu

READ MORE DAILY NEWS

- System of Air Quality and Weather Forecasting And Research (SAFAR) study

- Sabarimala temple Issue: SC verdict

- Office of the CJI comes under the RTI Act

- 11th BRICS summit

- The Index of Industrial Production

- What is New Zealand’s Zero Carbon Law?

- Brown to Green Report 2019

- New National Water Policy

- Suranga Bawadi

- Bushehr – Nuclear Power Plant

You are on the Best Online IAS preparation platform. You are learning under experts.

We are present on Facebook- Diligent IAS, LinkedIn- Diligent IAS, YouTube- Diligent IAS, Instagram- Diligent IAS. Get in touch with us.