Government sets up Rs.25000 crore Alternative Investment Fund 08/11/2019 – Posted in: Daily News – Tags: Alternative Investment Fund, escrow account, National Company Law Tribunal, non-performing assets, SBI and LIC

Alternative Investment Fund

For: Mains

Topics covered:

- What is the Alternative Investment Fund?

- What is an escrow account?

News Flash

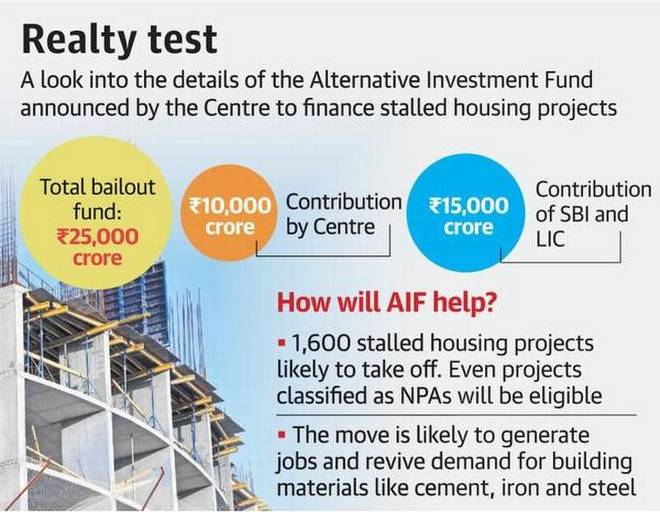

FinMin announced that the government will set up an alternative investment fund (AIF) of Rs 25,000 crore to provide relief to developers with unfinished projects to ensure delivery of homes to buyers.

In an internal survey, it is shown that around 4.58 lakh housing units were stuck in India with over 1,600 realty projects stalled. The AIF will provide relief to developers with unfinished projects and ensure delivery of homes to buyers.

Alternative Investment Fund

Highlights

- The fund size will initially be Rs 25,000 crore with the government providing ₹10,000 crore and the SBI and LIC providing the balance.

- The funds will be set up as Category-II AIF registered with the SEBI and will be managed by SBICAP Ventures Limited.

- Housing projects that have been classified as non-performing assets (NPA) and that are under National Company Law Tribunal (NCLT) proceedings also to be eligible for financing.

- Funds sanctioned for the stalled project will get transferred to an escrow account, money will be released as per the assessment and progress of construction.

- AIF is expected to support the sector and also helps in generating commercial returns for its investors.

Special Window to provide debt finance

The cabinet approved the establishment of an ‘Special Window’ to provide priority debt financing for completion of stalled housing projects in the affordable and middle-income housing sector.

Special Window to provide last mile funding to projects meeting these criteria:

- Net-worth positive

- Affordable & middle-income housing project

- On-going projects regd with RERA

- Reference by the existing lender

- Include stressed projects classified as NPA & NCLT

What is an escrow account?

Being in escrow is a contractual arrangement.

An escrow account is an account where funds are held in trust whilst two or more parties complete a transaction. This means a trusted third party will secure the funds in a trust account. The funds will be disbursed to the merchant after they have fulfilled the escrow agreement. If the merchant fails to deliver their obligation, then the funds are returned to the buyer.

Way Ahead

The AIF is expected to pool investments from other government-related and private investors, including public financial institutions, sovereign wealth funds, public and private banks, domestic pension and provident funds, global pension funds and other institutional investors.

The revival of the property sector will lead to the demand for cement, iron & steel industries giving further impetus to generate more employment.

Source: ET

READ MORE DAILY NEWS

- Indian Air quality Interactive Repository (IndAIR)

- Vaccine Hesitancy

- Danakil Depression

- Harmonized System (HS) code

- Online shopping as an addictive disorder

- ‘BAFTA Scotland’ Awards 2019

- High Energy Materials Research Laboratory

You are on the Best Online IAS preparation platform. You are learning under experts.

We are present on Facebook- Diligent IAS, LinkedIn- Diligent IAS, YouTube- Diligent IAS, Instagram- Diligent IAS. Get in touch with us.