The Bharat Bond Exchange Traded Fund approved by CCEA 22/12/2019 – Posted in: Press Information Bureau

Bharat Bond Exchange Traded Fund

Cabinet Committee on Economic Affairs

WHAT

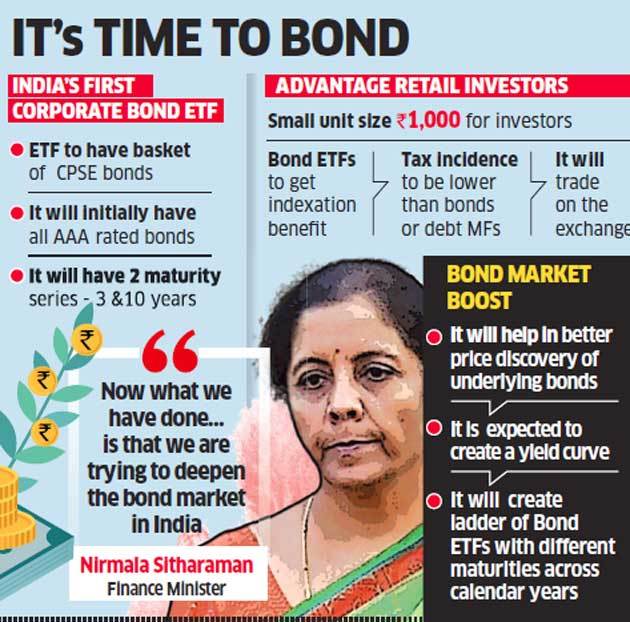

The Cabinet Committee on Economic Affairs has given its approval for the creation and launch of the Bharat Bond Exchange Traded Fund (ETF).

The Bharat Bond ETF will create an additional source of funding for Central Public Sector Undertakings (CPSUs) Central Public Sector Enterprises (CPSEs), Central Public Financial Institutions (CPFIs) and other Government organizations.

Bharat Bond ETF would be the first corporate Bond ETF in the country.

FEATURES OF BHARAT BOND ETF

- Tradable on exchange

- Small unit size Rs 1,000

- Transparent NAV (Periodic live NAV during the day)

- Transparent Portfolio (Daily disclosure on website)

- Low cost (0.0005%)

BHARAT BOND ETF STRUCTURE

- Each ETF will have a fixed maturity date

- The ETF will track the underlying Index on risk replication basis, i.e. matching Credit Quality and Average Maturity of the Index

- Will invest in a portfolio of bonds of CPSE, CPSU, CPFI or any other Government organizations that matures on or before the maturity date of the ETF

- As of now, it will have 2 maturity series – 3 and 10 years. Each series will have a separate index of the same maturity series.

INDEX METHODOLOGY

- The index will be constructed by an independent index provider – National Sock Exchange

- Different indices tracking specific maturity years – 3 and 10 years

BENEFITS OF BHARAT BOND ETF TO INVESTORS

- Bond ETF will provide safety (underlying bonds are issued by CPSEs and other Government-owned entities), liquidity (tradability on exchange) and predictable tax-efficient returns (target maturity structure).

- It will also provide access to retail investors to invest in bonds with smaller amount (as low as Rs. 1,000) thereby providing easy and low-cost access to bond markets.

- This will increase participation of retail investors who are currently not participating in bond markets due to liquidity and accessibility constraints.

- Tax efficiency compared to Bonds as coupons from the Bonds are taxed at marginal rates. Bond ETFs are taxed with the benefit of indexation which significantly reduces the tax on capital gains for investor.

DEVELOPMENTAL IMPACT ON BOND MARKETS

- Target Maturity Bond ETF is expected to create a yield curve and a ladder of Bond ETFs with different maturities across calendar years.

- ETF is expected to create new eco-system – Market Makers, index providers and awareness amongst investors – for launching new Bond ETFs in India.

- This is expected to eventually increase the size of bond ETFs in India leading to achieving key objectives at a larger scale – deepening bond markets, enhancing retail participation and reducing borrowing costs.

Source: PIB

READ MORE PIB UPDATES

- Indian Navy Day

- INAS 314 – “RAPTORS”

- Mission 41K

- Development of Loktak Inland Waterways Project

- Global Bio-India Summit, 2019

- NSS report no. 583: Persons with Disabilities in India

- NSS report no.584: Drinking-Water, Sanitation, Hygiene and Housing condition in India

You are on the Best Online IAS preparation platform. You are learning under experts.

We are present on Facebook- Diligent IAS, LinkedIn- Diligent IAS, YouTube- Diligent IAS, Instagram- Diligent IAS. Get in touch with us.