RBI issues final guidelines “on-tap” licence to small finance banks 08/12/2019 – Posted in: Daily News

“on-tap” licence

For: Preliminary & Mains

Topics covered:

- RBI guidelines and new changes for “on-tap” licence of Small Finance Banks

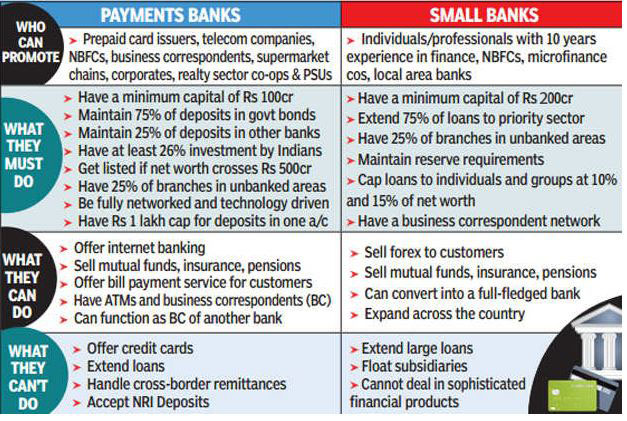

- About Small Finance Banks

News Flash

The Reserve Bank of India released final guidelines and opened the window for applicants to approach the regulator at any point of time for ‘on-tap’ licensing of Small Finance Banks (SFBs).

The minimum paid-up voting equity capital or net worth requirement has been set at Rs 200 crore, up from Rs 100 crore as set earlier.

Key Highlights

- Minimum capital norms would not be applicable for SFBs which came into operation after converting from urban cooperative banks, NBFCs/MFIs/local area banks and payment banks.

- The RBI has allowed any resident individuals/professionals, singly or jointly, having at least 10 years of experience in banking and finance to set up SFBs.

- The RBI said the promoters can hold a minimum of 40% of the paid-up voting equity capital of the bank at all times during the first five years.

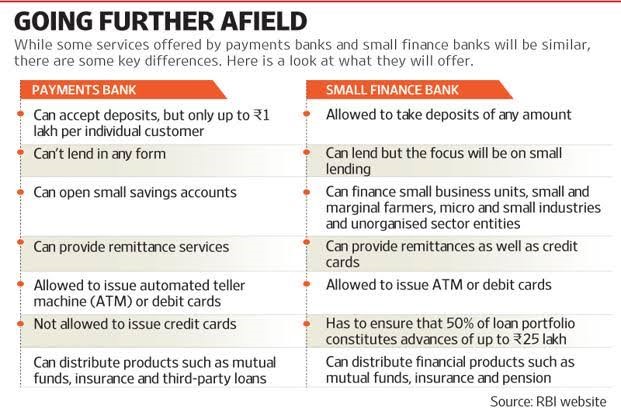

- Payments banks which have completed five years of operations are also eligible for conversion to small finance banks after complying with regulatory requirements.

- In view of the inherent risk of small finance banks, they shall be required to maintain a minimum capital adequacy ratio of 15 percent of its risk-weighted assets on a continuous basis.

- They also have to maintain a tier I capital of at least 7.5 percent of their risk-weighted assets while tier II capital should be limited to a maximum of 100 percent of the total tier I capital.

- Listing of SFBs will be mandatory within three years after the bank reaches a net worth of Rs 500 crore for the first time.

Small Finance Banks

SFBs are a type of niche banks in India. Banks with a small finance bank license can provide basic banking service of acceptance of deposits and lending.

The aim behind these to provide financial inclusion to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganised sector entities.

RBI-offers-on-tap-licence-to-small-finance-banks

Source: Moneycontrol

READ MORE DAILY NEWS

- Spike LR anti-tank guided missile

- International resolution on 5G

- Genetic study of clownfish population

- FASTag

- Electoral Literacy Clubs

- Extension of SC/ST reservation for another 10 years

- Quacquarelli Symonds (QS) World University Rankings for Asia 2020

- Automotive Telematics for Insurance

You are on the Best Online IAS preparation platform. You are learning under experts.

We are present on Facebook- Diligent IAS, LinkedIn- Diligent IAS, YouTube- Diligent IAS, Instagram- Diligent IAS. Get in touch with us.