Economic capital framework for RBI 14/06/2019 – Posted in: Daily News – Tags: bimal jalan committee

ECONOMIC CAPITAL FRAMEWORK FOR RBI

For: Mains

Topic covers: ECF for RBI, Jalan Committee, Committee’s mandate, Surplus cash with RBI

News Flash

The Bimal Jalan committee, which is looking into the size of capital reserves that the RBI should hold, will have one more meeting before finalizing its report.

The six-member panel, under former RBI Governor Jalan, was appointed on December 26, 2018, to review the economic capital framework (ECF) for the Reserve Bank after the Finance Ministry wanted the RBI to follow global best practices and transfer more surplus to the government.

Committee’s mandate

- To review status, need and justification of various reserves and buffers maintained by RBI.

- Review global best practices followed by central banks in making provisions for risks.

- Suggest adequate level of risk provisioning that RBI needs to maintain.

- Determine whether RBI is holding provisions, reserves and buffers in surplus or deficit.

- Propose suitable profits distribution policy.

Why delay in the report

A major difference of opinion is between the government’s representative on the panel, Economic Secretary, and other committee members over the transfer of “excess” capital reserves.

While some of the members are of the opinion that cash reserves should be transferred in a phased manner, the government wants to make it a ‘one-time transfer’.

Surplus cash reserves with RBI

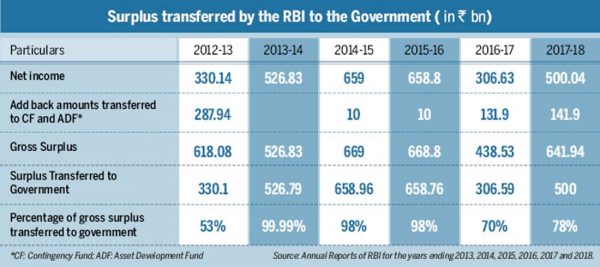

The transfer of RBI’s reserves to the government has been a contentious issue between the two sides for a long time. As of June 30, 2018, the RBI’s reserves stood at Rs 9.43 lakh crore, with a major portion of the reserves coming from contingency fund (Rs 2.32-lakh crore) and currency and gold revaluation account (CGRA) (Rs 6.91-lakh crore).

Background

- In the past, the issue of the ideal size of RBI’s reserves was examined by three committees – V Subrahmanyam (1997), Usha Thorat (2004) and Y H Malegam (2013).

- The current committee headed by Bimal Jalan is also charged with similar terms of reference.

- The Subrahmanyam committee recommended that the contingency reserve should be built up to 12 per cent, the Thorat committee said the reserve adequacy should be maintained at 18 per cent of the total assets.

- Mr. YH Malegam committee recommended that till such time the reserves were considered “excess” the complete surpluses should be transferred to the government as dividends.

- Following the recommendations of the Malegam committee in the year 2013-14 RBI transferred its entire surplus to the Government of India. This was a record amount of Rs.526.79 billion.

- In the four years preceding RBI had transferred around 52% of its total surplus to the government.

Source: Business Today/ The Hindu

You can follow us on LinkedIn and for more updates related to UPSC IAS Preparation, Like our Facebook Page and subscribe our Diligent IAS Youtube Channel