Andhra Pradesh seeks Special Category Status 27/05/2019 – Posted in: Daily News – Tags: andhra pradesh, special category state

SPECIAL CATEGORY STATUS

For: Preliminary & Mains

Topic covers: SCS – its process, features and advantages.

News Flash

Andhra Pradesh Chief Minister met Prime Minister to raise the unfulfilled demand of the Special Category Status (SCS).

Why seeking SCS?

- The State’s debt burden is very high due to bifurcation.

- It was Rs. 97,000 crore at the time of bifurcation, now, it has swelled to Rs. 2.58 lakh crore.

Special category state

The Constitution does not include any provision for categorisation of any State in India as a Special Category Status (SCS) State. But, recognising that some regions in the country were historically disadvantaged in contrast to others, Central plan assistance to SCS States has been granted in the past by the erstwhile Planning Commission body, National Development Council (NDC).

The concept of a special category state was first introduced in 1969 when the 5th Finance Commission sought to provide certain disadvantaged states with preferential treatment in the form of central assistance and tax breaks.

The NDC granted this status based on a number of features of the States which included:

- Hilly and difficult terrain.

- Low population density or sizeable share of tribal population

- Strategic location along borders with neighbouring countries

- Economic and infrastructural backwardness

- Non-viable nature of state finances.

- The decision to grant special category status lies with the National Development Council.

What kind of assistance do SCS States receive?

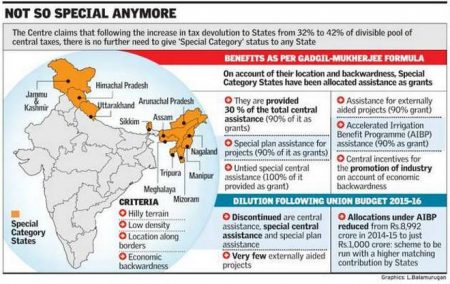

The SCS States used to receive block grants based on the Gadgil-Mukherjee formula, which effectively allowed for nearly 30 per cent of the Total Central Assistance to be transferred to SCS States as late as 2009-10.

Following the constitution of the NITI Aayog (after the dissolution of the Planning Commission) and the recommendations of the Fourteenth Finance Commission (FFC), Central plan assistance to SCS States has been subsumed in an increased devolution of the divisible pool to all States (from 32% in the 13th FC recommendations to 42%) and do not any longer appear in plan expenditure.

The FFC also recommended variables such as “forest cover” to be included in devolution, with a weightage of 7.5 in the criteria and which could benefit north-eastern States that were previously given SCS assistance. Besides, assistance to Centrally Sponsored Schemes for SCS States was given with 90% Central share and 10% State share.

Benefits of the Special Category states

- Exemption from excise duty, customs duty, corporate tax, income tax and other taxes to attract investment.

- Centre bears 90% of the state expenditure (given as grant) on all centrally-sponsored schemes.

- While rest 10% is given as loan to state at zero percent rate of interest.

- 30% amount of planned expenditure of the central budget goes to ‘Special Category’ States.

- SCS have the facility that if they have unspent money in a financial year; it does not lapse and gets carry forward for the next financial year.

Current SCS states: Arunachal Pradesh, Assam, Himachal Pradesh, Jammu & Kashmir, Manipur, Mizoram, Tripura, Uttrakhand, Sikkim, Meghalaya, Nagaland

SCS seeking states: Bihar, Andhra Pradesh, Rajasthan, Goa, Odisha

Source: The Hindu

You can follow us on LinkedIn and for more updates related to UPSC IAS Preparation, Like our Facebook Page and subscribe our Diligent IAS Youtube Channel