Stressed Asset Norms 08/06/2019 – Posted in: Daily News – Tags: NPA, RBI

STRESSED ASSET NORMS

For: Mains

Topic covers: Stressed Assets, New Norms, NPA, Restructured Loan

News Flash

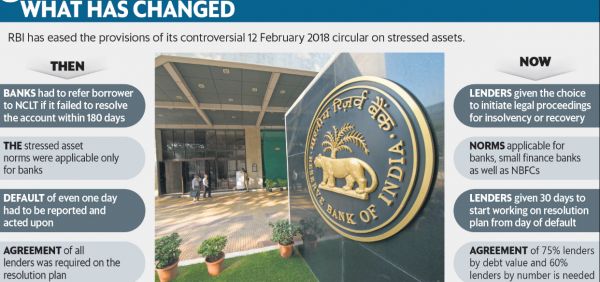

The Reserve Bank of India (RBI) recently issued a new prudential framework for resolution of stressed assets, giving lenders leeway to review a borrower account within 30 days of default.

RBI stipulates additional provisions in case of delayed implementation of the resolution plan (RP).

The new framework gives lenders a breather from the one-day default rule whereby they had to draw up an RP for implementation within 180 days of the first default.

It gives lenders (scheduled commercial banks, all-India financial institutions and small finance banks) 30 days to review the borrower account on default.

The new circular is applicable to Schedule Commercial Banks, small finance banks and systemically important non-deposit taking non-banking financial companies (NBFCs) and deposit-taking NBFCs.

Resolution Plan

In cases where the resolution plan (RP) is to be implemented, all lenders have to enter into an inter-creditor agreement (ICA) for the resolution of stressed assets during the review period to provide for ground rules for finalisation and implementation of the RP in respect of borrowers with credit facilities from more than one lender.

Under the ICA, any decision agreed to by the lenders representing 75 per cent of total outstanding credit facilities by value and 60 per cent by number will be binding upon all the lenders.

In particular, the RPs will provide for payment which will not be less than the liquidation value due to the dissenting lenders.

Additional provisions

If the implementation of an RP crosses the stipulated 180 days from the end of the review period, the lenders have to make additional provisions of 20 per cent of the outstanding loan.

If this timeline exceeds 365 days, they further have to make a provision of 15 per cent.

These additional provisions are over and above the provisions already held or the provisions required to be made as per the asset classification status of the borrower account.

Circular

- Lenders will get a breather from the one-day default norm

- They will get a 30-day review period to frame a resolution strategy

- They have to submit a weekly report to the RBI on defaults by borrowers with exposure of ₹5 crore and above

- New norms also applicable to small finance banks and large NBFCs

Stressed Assets

Stressed assets = NPAs + Restructured loans + Written off assets

- Stressed assets are a powerful indicator of the health of the banking system.

To understand stressed assets we have to understand NPA and Restructured assets.

Assets of the banking system comprises of loans given and investment (in bonds) made by banks. Quality of the asset indicates how much of the loans taken by the borrowers are repaid in the form of interests and principal. The most important scale of asset quality is Non Performing Assets (NPA). An NPA means interest or principal is not repaid by the borrower during a specified time period.

Bad assets are further classified into substandard asset, doubtful asset, and loss assets depending upon how long a loan remains as an NPA.

NPA

A loan whose interest and/or installment of principal have remained ‘overdue ‘ (not paid) for a period of 90 days is considered as NPA.

Restructured Loans

Restructured asset or loan are that assets which got an extended repayment period, reduced interest rate, converting a part of the loan into equity, providing additional financing, or some combination of these measures.

Written Off Assets

Written off assets are those the bank or lender doesn’t count the money borrower owes to it. The financial statement of the bank will indicate that the written off loans are compensated through some other way. There is no meaning that the borrower is pardoned or got exempted from payment.

Source: The Hindu businessline

You can follow us on LinkedIn and for more updates related to UPSC IAS Preparation, Like our Facebook Page and subscribe our Diligent IAS Youtube Channel

Also Read Related Daily News